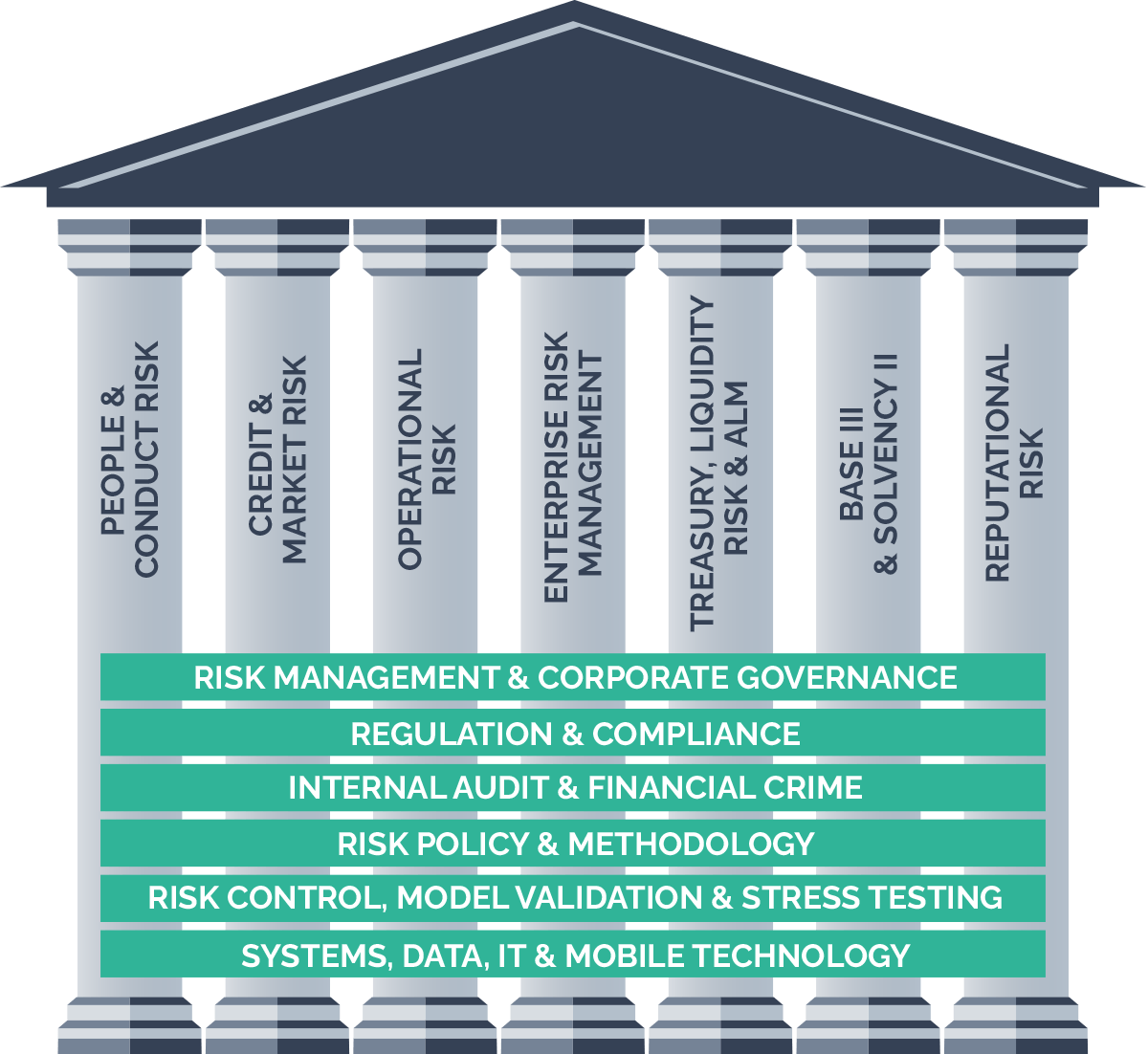

- New Trends in Risk, Audit & Compliance for Banks and Financial Institutions

- Implementing Solutions to Mitigate Cybersecurity Risk

- Ethics and Culture Risk – Implementation and Management for Corporations

- Risk in Financial Services for Banking, Finance & Asset Management

- Stress Testing on Liquidity Risk

- Operational Resilience and Business Continuity Management for Banks & Financial Institutions

- Credit Risk, SME Lending and Business Development

- NEW Climate Risk Management & the NEW BIS Rules for Banks

- IFRS9 & Credit Impairment post- Covid 19

- NEW Certified Chief Risk Officer (Banking and Finance)

- NEW Early Warning Signs for Bank Risk Managers

- NEW Risk in Internet Banking

- NEW ESG and Risk Management