04 Oct Inflation – Governments Should Not Be Raising Interest Rates

Inflation – Governments Should Not Be Raising Interest Rates

Dennis Cox, CEO Risk Reward Ltd, is a well-known international advisor on risk, audit and compliance to both financial regulators and regulated financial institutions worldwide. This article follows a recent 3-day webinar for USA banks and pension fund managers.

The headlines are focused worldwide on inflation. It is clearly back after a long hiatus and with a vengeance. It has risen quickly, and central banks globally are responding by taking action to try to calm the rate of its increase. The question we need to answer is, do these actions actually make sense?

Classical inflation is either driven by cost inflation or wage inflation. Cost inflation is a consequence of an imbalance of supply and demand resulting in increasing competition driving up prices. Wage inflation occurs when there is either a shortage of available labour or labour believe that inflation is likely to erode their earnings. As such wage inflation can easily outstrip price inflation.

Stress Events

This time, however, the economic environment is rather different. We all know that the inflation we have was caused by two separate events. The first has been the COVID pandemic and the consequential fiscal actions taken globally. Supply chains were severely disrupted and competition for resources significantly increased costs. This could be seen from commodities through to freight and logistics.

The second event is the continuing crisis in the Ukraine and its impact on both oil and gas and staple grain prices. The Russian Federation GDP at $1.48tn is almost identical with that of Brazil ($1.45tn) and it ranks around 11th in the world. It is however a major player in three markets: oil, gas and palladium. This caused the oil price and the gas price to spike.

Both of these are unexpected events which companies will have considered within their stress testing analysis. The first event (COVID) appears to be coming to an end and the impacts of that event are now slowly reversing, albeit that the consequential level of borrowing is a slowing factor on global growth. The second event (Ukraine) is continuing although markets appear to have factored in much of the potential downside from this event.

The Impact of Raising Interest Rates

Why does this matter? Classic answers for inflation management attach themselves to classic concerns. They will not necessarily be appropriate in an environment resulting from events which are not standard. The causes of the rise in inflation globally this time are stress events which will at some stage come to an end. Consequently, raising interest rates to reduce the speed of the growth of inflation can itself be both unproductive and unnecessary.

Rising interest rates impact any party that has floating rate borrowings, requiring companies to raise prices to recover the interest and consumers to either reduce consumption or seek higher remuneration. In other words, the raising of interest rates could cause inflation and/or a reduction in growth. From a government point of view with the level of global debt at an all time high, this increases the cost of servicing the debt, resulting in less assets being available to invest or support the economically disadvantaged. The other effect of raising interest rates is that is disables the fixed rate debt market. Generally, if rates are rising investors will choose to wait for the higher rates or choose to acquire interest or inflation linked notes. That also leads to yield curves becoming unstable.

So what would happen if there was no increase in interest rates. Would inflation naturally fall?

Consider the key drivers of inflation this time – commodities, and freight costs.

Commodity Prices

The price for WTI crude today (30 Sept 2022) is $80.82. The peak on 8 June was $122.22. The price for gas today is $360.50. The peak on 26 Aug was $702.95. Both of these prices have fallen considerably. For the rate of inflation to remain at its current levels the price of these commodities would have to climb to levels we have never seen, whereas they have actually fallen. Once the higher prices drop out of the annual data set then the reduction in inflation contribution will follow.

Is this replicated in other commodities? Aluminium at $2,092 USD was at a 52-week low down from $3,732 on 3 March. Copper was at $10,800 in February. It is now down to $7,442. The global container index has also fallen from a peak of $10,991 in September 2021 to $4,060 today. As you look at this data you can see that as these lower energy and commodity prices flow through the economy this will lead to a reduction in inflation.

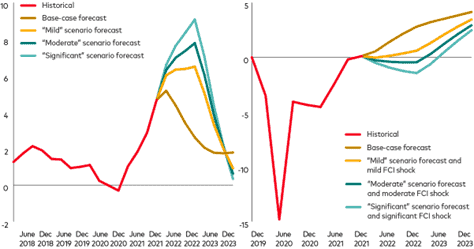

Hence the expectation is that if nothing were done on inflation it would subside. This is shown in the research reports of many firms and central banks. The following expectations appear within the Vanguard analysis and are purely increased as an example after both stress events have occurred.

Conclusion

What should be our real concerns? If interest rates are used to try to reduce inflation which is not caused by classical events, then the consequences will be negative for an economy and lead to actually increasing inflation whilst reducing growth. If interest rates are not raised, then the price increase for a period of perhaps a year will need to be addressed since it erodes savings and sustainable free cashflow of particularly the most disadvantaged but raising interest rates will not help them either.

So the question is should rates rise or not? From our perspective there does not seem to be sufficient evidence that would suggest that governments’ raising interest rates is the sensible approach.

As usual your feedback is welcomed.

Dennis Cox

DWC@riskrewardlimited.com

30 September 2022