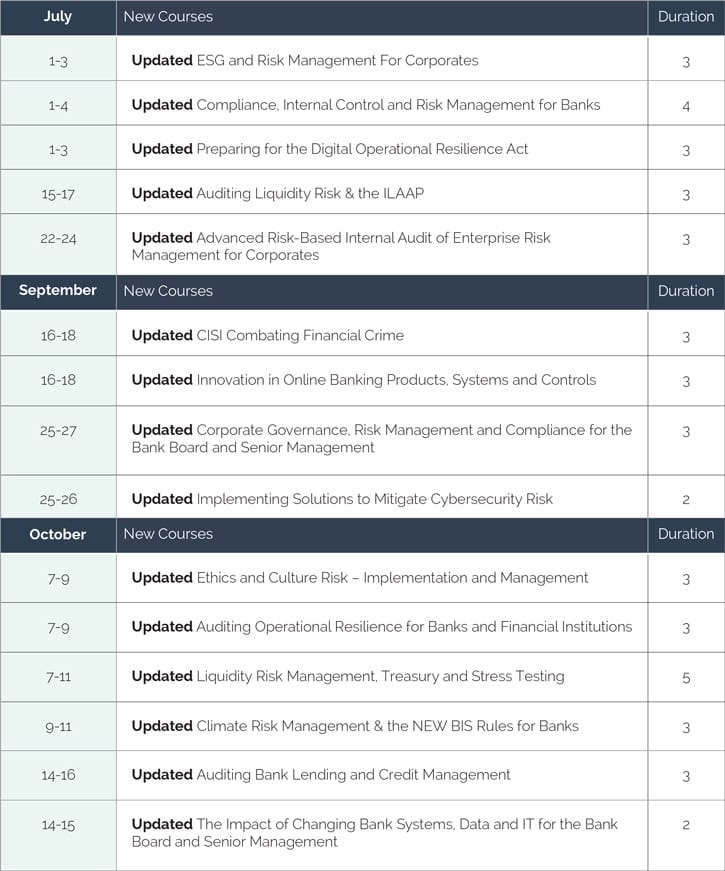

Showing 1–12 of 108 results

-

Internal Audit

Jul 15 - 17 2024

Jul 15 - 17 2024Updated Auditing Liquidity Risk & the ILAAP

IA086Duration: 3 days

Cost: £3,495.00

Location: UK EU MENA WAT GCC Time ZonesPopularCourse Details > -

Internal Audit

July 22 - 24, 2024

July 22 - 24, 2024Updated Advanced Risk-Based Internal Audit of Enterprise Risk Management for Corporates

IA084Duration: 3 days

Cost: £3,495.00

Location: UK EU MENA WAT GCC Time ZonesPopularCourse Details > -

Financial Crime

Sep 16 - 18 2024

Sep 16 - 18 2024Updated CISI Combating Financial Crime

FC008Duration: 3 days/2.5 days + mock exam

Cost: £3,195.00

Location: UK EU MENA WAT GCC Time ZonesCertificatedCourse Details > -

Sept 16 – 18 2024

Sept 16 – 18 2024Updated Innovation in Online Banking Products, Systems and Controls

SDIT300Duration: 3 days

Cost: £3,495.00

Location: UK EU MENA GCC WAT Time ZonesTrendingCourse Details > -

C-Suite Innovation

Sept 25 – 27 2024

Sept 25 – 27 2024Updated Corporate Governance, Risk Management and Compliance for the Bank Board and Senior Management

RM031Duration: 3 days

Cost: £3,995.00

Location: Global Markets and Times ZonesTrendingCourse Details > -

Financial Crime

Sept 25 – 26 2024

Sept 25 – 26 2024Updated Implementing Solutions to Mitigate Cybersecurity Risk

FC400Duration: 2 days

Cost: £2,495.00

Location: UK EMEA WAT GCC time zonesTrendingCourse Details > -

Risk Management

Oct 07 - 09 2024

Oct 07 - 09 2024Update Ethics and Culture Risk – Implementation and Management

CORP021Duration: 3 days

Cost: £2,995.00

Location: UK EU MENA WAT GCC Time ZonesTrendingCourse Details > -

Internal Audit

Oct 07 - 09 2024

Oct 07 - 09 2024Updated Auditing Operational Resilience for Banks and Financial Institutions

IA092Duration: 3 days

Cost: £3,495.00

Location: Global Market & Time ZonesTrendingCourse Details > -

Oct 07 – 11 2024

Oct 07 – 11 2024Updated Liquidity Risk Management, Treasury and Stress Testing

RM064Duration: 5 days

Cost: £4,995.00

Location: UK Europe EMEA GCC Time ZonesTrendingCourse Details > -

Risk Management

October 09 – 11 2024

October 09 – 11 2024Updated Climate Risk Management & the NEW BIS Rules for Banks

RM600Duration: 3 days

Cost: £2,995.00

Location: UK EU MENA WAT GCC Time ZonesTrendingCourse Details > -

Internal Audit

October 14 - 16 2024

October 14 - 16 2024Updated Auditing Bank Lending and Credit Management

IA018Duration: 3 days

Cost: £3,495.00

Location: Global Markets & Time ZonesBest SellerCourse Details > -

Digital Banking, Payment Systems & IT

Oct 14 - 15 2024

Oct 14 - 15 2024Updated The Impact of Changing Bank Systems, Data and IT for the Bank Board and Senior Management

SDIT001Duration: 2 days

Cost: £3,495.00

Location: UK Europe MENA GCC WAT Time ZonesTrendingCourse Details >